Cutting tools like drill bits, end mills, etc. are crucial components of a machine’s usage in numerous industries. For a hip replacement, doctors need cutting tools that shapes and implants the associated bone. An oil and gas company require cutting tool to make accurate incisions in pipes and wells. These are few out-of-many applications where usage of cutting tools are necessary.

For past few years, 1.5 percent annual growth in the US cutting-tool sector is observed. Simultaneously, the marketing sector consolidated with the cutting-tool manufacturers and undertook above 200 acquisitions and mergers totaling $4 billion since then and growing.

As per report of USCTI (US Cutting Tool Institute) and Association For Manufacturing Technology (AMT), the total consumption of the tools stands at $1.6 billion. It concludes a 7.9% higher consumption during 10-month course compared in 2020.

Despite of gradual growth, the cutting-tool manufacturers selling end mills, drill bits etc. may become capable to capture more value provided they predict the changes that lies ahead and modify their long-term marketing strategy. Various market trends, research data and interviews of over 50 executives has been deeply examined to know the changes required to grow marketing sector.

This analysis concluded to some significant outcomes. It revealed the stability of overall market growth but also informed the rising customer’s demand for cutting tools. It further stated that now customers will take into account various factors during the purchase like competitive pricing and quality. The report further provided important insight revealing that cutting tools suppliers are capable to acquire more value if they improvise their distribution network and pricing. These two areas were ignored for many years.

Following are the areas that demand improvisation by professional marketers in order to generate the value the ignored-sector is rightful to demand.

CUSTOMER’S DEMAND SHIFT

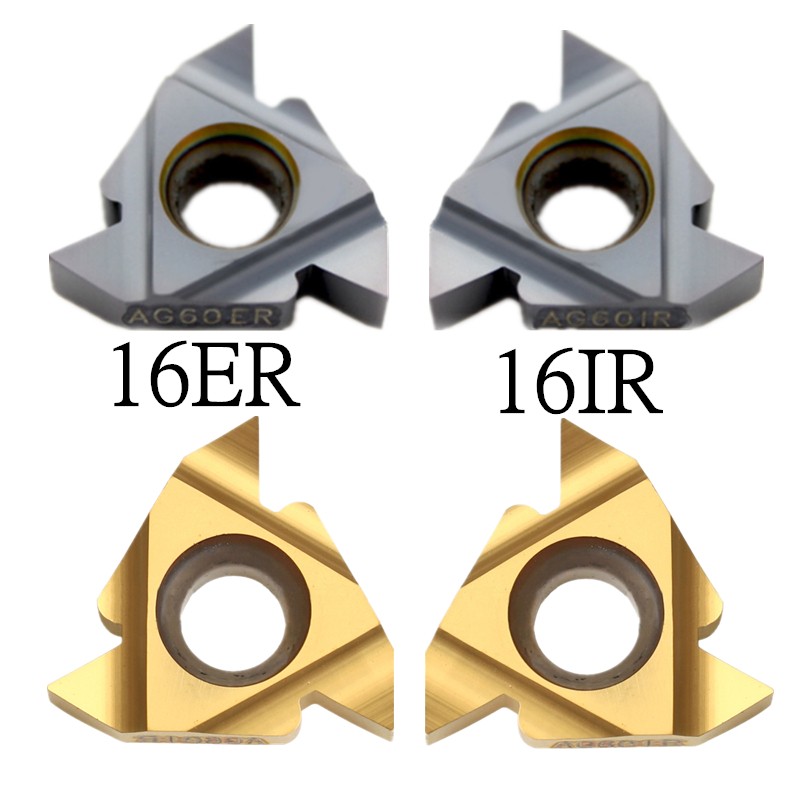

Currently, the US cutting-tools market consists of value of about $5 billion, mostly coming from miiling tools that generates 38 percent of the total value. Furthermore, the indexable tools, available in removable cutting tips, are rapidly growing at higher rate compared to solid tools including carbide and non-carbide because the indexable tools are more economic and easily repairable compared to solid tools.

Though the overall demand of cutting tools will thrive at a consistent rate, the indexables are predicted to outspace solid tools.

Since the customers are revolving in industries alternating between contraction and expansion, a big change in the source of growth is expected. The prediction says that aerospace and defense sector, crowned to generate more demand up to 2017 will fall behind to the sectors seeking growth.

On the contrary, the demand in the medical sector, which is non-cyclic, will be stable. This sector, comprising of orthopedic and surgical cutting tools, will become haven for vendors seeking protection against economic turmoil.

FACTORS IMPACTING THE RATE OF RETENTION AND PURCHASE

The most important factor in deciding the purchase and retention rate is the customers’ criteria in the selection of cutting-tools vendors. Results of extensive interviews carried out with customers show one dominant factor, recommendation by distributor. Since new cutting tools are flourishing the sales market, customers rely heavily on distributors that understands their demands, potential use case and available offerings to a customer’s specific requirement.

An executive of leading industry stated the since the distributors have deep understanding of different catalogs, they provide “first-line” knowledge on which cutting tool to use and which is the best-suited brand for a new application. As a result, the customers are discouraged to shift to large online retailers to make a purchase. Though the customers also take referrals and advertisement into account for considering cutting tools vendors, they weight lesser than recommendation of the distributors.

Managers also play vital role in the rate of retention and purchase. When they are deployed in purchasing sector, they base their opinion of tool’s performance like reliability, quality and wear and tear etc. In fact, most of them actually try tools to check heat dissipation and other factors prior to promote the brand to their customers. Once satisfied, they not only stick to the tool but also promote the brand to customer hence providing a 75 percent retention rate to the sales and purchase sector.

The analysis also concluded that customers investigate new proposals for a new type of application if their existing cutting-tool manufacturers selling end mills etc. is unable to provide or they face unsatisfactory quality issues. Some customers reported to have an interaction difficulty with manufacturers due to lack of innovation or insufficient technical support.

SELECTION OF THE STRONG DISTRIBUTOR

Since the distributors plays vital role in the marketing sector, an investigation conducted with companies inquiring how they work with them. The investigation told that many cutting-tool companies are dealing with wide range of distributor networks in US. These network vary in size with some having less than 100 branches while others over 450. But the results showed cutting-tool companies did not emphasis on the location of branches. Instead they preferred branches located near an industrial hub, which are now declining gradually. Therefore, the distribution strategy failed to meet the changes in demand, they lost or have little coverage in prime locations. Similarly, their distribution partner may have branches in declined-industrial areas. Therefore, this imbalance is not merely an organization issue because the recommendations of distributors weighs the most in purchasing decisions.

This investigation narrows to an important question. What factors cutting tools suppliers should consider in deciding if they require a distributor? One answer is machinery-manufacturing activity and its GDP contribution. The cutting-tool manufacturers using this instrument can quantify every metropolitan service area (MSA) in US and divide markets into three categories, small, medium and large. To gain more detailed analysis, they can calculate compound annual growth rate for next upcoming years. This division further divides into marketing sectors. The small MSA market having limited growth will have the least number of distributors, whereas the big areas having high growth will have most distributors. Other MSAs will lie in between these two categories.

Because the cutting-tool manufacturers must look regularly for each MSA demands and improvise, the analysis of distribution practices is a test and trial error basis. Another consideration to grow USA cutting-tools market is hiring distributors with a nationwide-access portfolio. Though moving to large distributor may increase your expenses by 5 to 10 percent more, but these larger distributors can bring higher business to your companies as comparatively. Reports from the interviews conducted earlier also shows that company’s owners belief on financial growth if they tie business with these giants.

MORE REFINED PRICING

Apart from distribution, the cutting-tool companies can gain competitive advantage by developing a strong pricing which does not focus merely on margin by find options to capture market. Below are the critical elements for pricing.

Deriving appropriate value by low-volume SKU

If vendors fail to supply cutting tools at the customer demand, they might switch to competitors that ensures them of the tool’s prompt availability. This scenario pushes the cutting-tool companies towards stock SKUs which is a low demanded sector although it raises the inventory cost. When it comes to pricing these SKUs, many companies practice same pricing formula as used for high-demanded products that readily sells off the shelves. So their revenues will increase with the strong understanding of customer’s demand and time of purchases. Now the cutting tools suppliers can develop pricing strategy which includes inventory expenses for low-volume SKUs that include high carrying cost.

Gain more intelligence about competitive pricing

During consolidation of cutting-tool market, most of the companies try differentiating from low prices. But they must also keep a keen eye on competitor pricing and improvise accordingly. Since it is practically impossible to acquire information about each and every tool available in the market, setting important trends like growth in end market, distribution channel etc. that can impact the market will be wiser move. To sum up, companies should monitor pricing periodically where they had strong presence and also where they can increase their market share.

Value-added services grouped with tools

While setting prices for the cutting tools, companies focus on its manufacturing cost, profit margins and how much customer is able to pay. But they can capture more market and grow their revenue if they start bundling the charges with customer service and support with the price of the tool rather covering them in an individual contract.

For example, cutting-tool manufacturers, while selling a specific cutting tooi might promise for 24/7 customer support or offers a charge-free repairing person in case the tool damages or breakdowns. This offer will be eye catching for the customers willing to move production as they will recognize the benefits they can reap especially if they encountered bad customer experience with the competitor’s product. Furthermore, the customer will stay loyal with companies providing such services thereby increasing recurring revenues, an investment most appreciated by investors.

CONCLUSION

Each year the cutting-tool industry introduces fresh products in the market boasting improved technology and more ease in usage. Similarly, these companies should also introduce the products to distribution networks and improvise pricing strategies. With the continuing market evolution becoming more competitive annually, the cutting-tool companies that stuck in the old practices may never boom in the future.

The cutting tools suppliers now need to think what customer shift lies ahead and plan their marketing accordingly, otherwise their revenue will collapse shortly. They need to think what factors they need to focus to increase sales and purchase retention, is it the lack from sales team or the unsatisfactory results from the tool that annoys the customer. What distribution network are using, should they revamp to a larger distributor.